Why do prospects buy? This is an age old question, and truth be told, sales people have tried numerous methods to try to get prospects to buy. But unfortunately, these methods are generally traditional, canned, weak, and predictable.

Tags: prospecting, sales techniques

Should Your Client Take Fixed or Variable Loans?

Posted by Jason Konopik on Mon, Aug 08, 2016 @ 05:07 PM

Life insurance provides valuable protection for loved ones. While the primary purpose of pure life insurance protection is to provide a death benefit, many cash-value products offer "living benefits" that you can take advantage of during your lifetime. One major living benefit of cash-value life insurance is access to the cash values in times of need, such as to help pay for a child's education or to help fund retirement.

Why Traditional Financial Services Sales Closing Techniques Fail

Posted by Partners Advantage on Wed, Aug 03, 2016 @ 05:23 PM

Sales closes come in all shapes and sizes. Some are technical, some have a cliché feel to them, and some of them are just old, out of date, and ineffective. To shed a little light on this subject, lets discuss one of the oldest traditional closing techniques on the planet, the “Ben Franklin Close”, which doesn’t work.

Tags: prospecting, sales techniques

To amplify the power of Internal Revenue Code (IRC) Section 7702 many producers wonder what is the best way to structure a life insurance policy if given the choice of using either the Cash Value Accumulation Test (CVAT) or the Guideline Premium Test (GPT). For this reason, making the proper choice -- or selecting a product with the specific test more favorable to the plan design -- is an important issue when structuring the policy. The test selected can have a significant impact on premiums, cash values and death benefits.

How much of your business's information is stored on computers or online? What about your client files? It is critical to keep your business's data and your client information safe. There are a few simple measures that could increase the security of your information.

Tags: practice management

We continuously strive to help agents grow their practice through proven prospecting and business management programs. During our initial meetings with agents from all across the country, one of the main questions we ask is, "What's your annual marketing budget?" This is a pivotal question and the answer we hear is telling.

Impact of Words and Selling Permanent Life Insurance

Posted by Partners Advantage on Thu, Apr 07, 2016 @ 11:08 AM

Tags: IUL (indexed universal life insurance), sales techniques

With the proliferation of social media accounts, and their overall acceptance in the financial services marketplace, many producers wonder how to start the process of prospecting for IUL clients with Facebook or Twitter. It really comes down to a few key elements:

Tags: IUL (indexed universal life insurance), prospecting, retirement strategies

Five Things Clients Should Consider Before Saving Money For Retirement

Posted by Partners Advantage on Tue, Feb 23, 2016 @ 12:54 PM

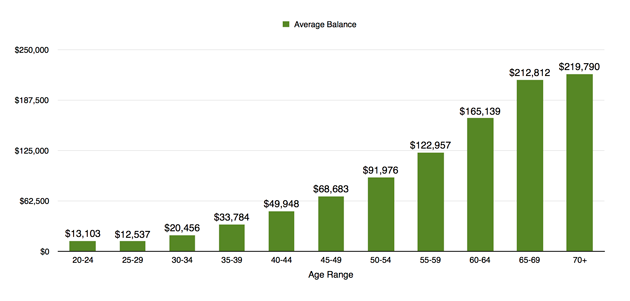

Before we get started, let's get real. Most people aren't saving enough money for retirement. According to a 2015, Employee Benefit Research Institute study, here's the average retirement savings balance for various age groups:

Tags: IUL (indexed universal life insurance), retirement strategies

FOR PRODUCER USE ONLY. NOT FOR USE WITH CLIENTS.

This content is for informational and educational purposes only and is not designed, or intended, to be applicable to any person's individual circumstances. It should not be considered as investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action.